Vendor Finance

- Going deeper to Tier 2/3 vendors by tracking past performance.

- Broaden availability of the product to BBB or lower rated anchors by capturing anchor sales as a mitigant.

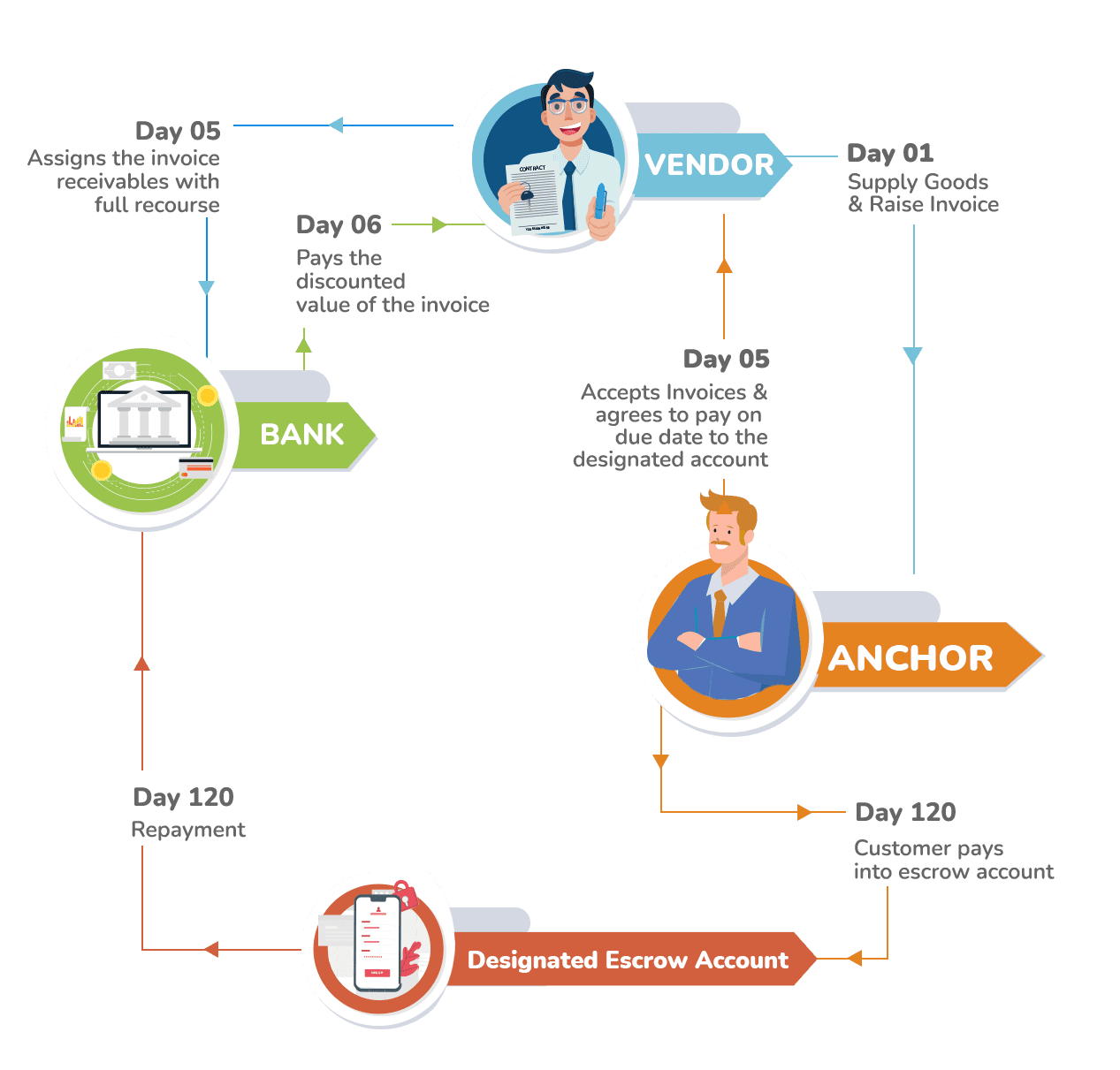

Vendor Finance in the form of receivable discounting or unsecured loans for invoice discounting is a well established product in India. It is largely confined to A+ or better rated companies. This product is a better mitigant against loss due to clear end use supported by sales ledger analysis to prevent misuse. Technology can be a significant enabler of risk mitigation strategies.

Vendors

- Unsecured: Typically Vendors borrow against hard collateral – plant and machinery, land and building and often the promoters personal real estate assets. Vendor finance ( in the form of confirmed payable) allows for an unsecured credit limit linked to the Anchor’s credit.

- Lower CoF: Cost of a Vendor finance line is usually borne by the Anchor or adjusted in the unit sale price of supplies. Hence costs tend to be lower than the average cost of finance for a vendor.

Anchors

- Helps strengthen the supply chain of an anchor corporate through providing working capital support to small vendors ( read MSME) who are usually un-banked.

- Off balance sheet funding without impacting bank borrowings thus helping leverage ratio.

- With suitable structure and rating alternate investor segments can be reached for funding diversification and lower cost.

Lenders

- Lenders to Anchors usually get paid from post EBITDA Cash flows, while Supply chain Vendor finance gets paid out of the COGS line.

- Linking one’s fate to top line items – supplier bills or receivables can improve the access to company’s cash flows and allow for early reductions and exits.

Pre-approved Buyers List

- J. P. Morgan Services India Private Limited

- J. P. Morgan India Private Limited

- CGI

- Deloitte

- Bank of America

- Eclerx

- L & T Infotech

- Nayara

- Amazon Seller service Pvt Ltd

- Amazon Transportation Service Pvt Ltd

- Accenture Solutions Pvt Ltd

- Abbott Healthcare Pvt Ltd

- Abbott India Limited

- Dell International Services India Pvt Ltd

- EMC SOFTWARE AND SERVICES INDIA PVT. LTD.

- Jubilant Food Works Limited

- Neyveli Lignite Corporation Ltd (NLC India Ltd

- NTT DATA Global Delivery Services Private Ltd

- NTT Data Information Processing Services Pvt. Ltd

- Mahanagar Gas Ltd

- Hindalco Industries Ltd

- Ultratech Cement Ltd

- Mondelez India Ltd

- Hindustan Unilever Ltd

- Reliance Industries Ltd

- Hindustan Unilever Ltd

- Britannia Industies Ltd

- Flipcart Internet Pvt Ltd

- Instakart Services Pvt Ltd

- Myntra Design Pvt Ltd

- Dabur India Ltd

- Tata Power Company Ltd

- Tata Consumer Products Ltd

- Axis Bank Ltd

- ITC Ltd

- TATA Motors Ltd

- Indian Oil Corporation Limited

- HINDUSTAN PETROLEUM CORPORATION LIMITED

- CHENNAI PETROLEUM CORPORATION LIMITED

- NTPC LIMITED

- Dabur India Ltd

- LARSEN & TOUBRO LIMITED

- Hindustan Aeronautics Ltd

- Bharat Petroleum Corporation Limited

- Hero Motocorp Limited

- Ion Exchange (India) Ltd

- JBM Auto Limited

- TiTagarh Wagons Limited

- Butterly Gandhimathi Appliances Limited

- LT Foods Limited

- Oil India Limited

- Power Grid Corporation of India Limited

- Rashtriya Chemicals and Fertilizers Limited

- Force Motors Limited